Creating and living by a budget is a crucial step towards achieving financial stability and meeting your financial goals. However, many people find themselves wondering when the right time is to start this important practice. Is it after receiving a raise, upon graduating, or after settling into a new job? In reality, the best time to start budgeting is different for everyone, but there are key moments and milestones in life that signal it’s time to take control of your finances. Let’s explore these pivotal moments and how to create a budget that works for you.

Understanding the Importance of Budgeting

Before diving into the timing, it’s essential to understand why budgeting is vital. A budget allows you to:

- Track Your Income and Expenses: It helps you see where your money is going and identify areas where you can save.

- Achieve Financial Goals: Whether it’s saving for a vacation, buying a home, or planning for retirement, a budget is your roadmap.

- Prepare for Emergencies: An emergency fund is crucial, and budgeting allows you to allocate funds for unexpected expenses.

- Reduce Financial Stress: Knowing your financial situation can alleviate anxiety and provide a sense of control.

Key Moments to Start Budgeting

- Entering the Workforce: If you’ve just landed your first job, it’s an excellent time to start budgeting. This new income can be overwhelming, and without a budget, it’s easy to overspend or live paycheck to paycheck. Start by tracking your earnings and expenses, and set financial goals, such as saving for a car or paying off student loans.

- Graduating College: Graduation often comes with new financial responsibilities, including student loan payments. Creating a budget at this stage can help you navigate the transition from school to the working world. It’s also an ideal time to build an emergency fund and start saving for retirement, even if it’s a small amount.

- Starting a Family: Major life changes, such as marriage or having children, usually come with increased expenses. A budget will help you manage these new financial responsibilities, plan for childcare, and save for future expenses like education.

- Receiving a Raise or Promotion: A pay increase is a perfect opportunity to reassess your budget. Instead of simply increasing your spending, consider allocating a portion of your raise towards savings, investments, or debt repayment. This can have a significant long-term impact on your financial health.

- Experiencing a Financial Setback: Life can throw unexpected challenges your way, such as job loss, medical emergencies, or other financial crises. If you find yourself in a tough spot, creating a budget can help you regain control over your finances and develop a plan to recover.

- Planning for Retirement: Regardless of your age, it’s never too early to start planning for retirement. If you haven’t already created a budget, now is the time. Consider how much you need to save for retirement and adjust your current budget to include contributions to retirement accounts.

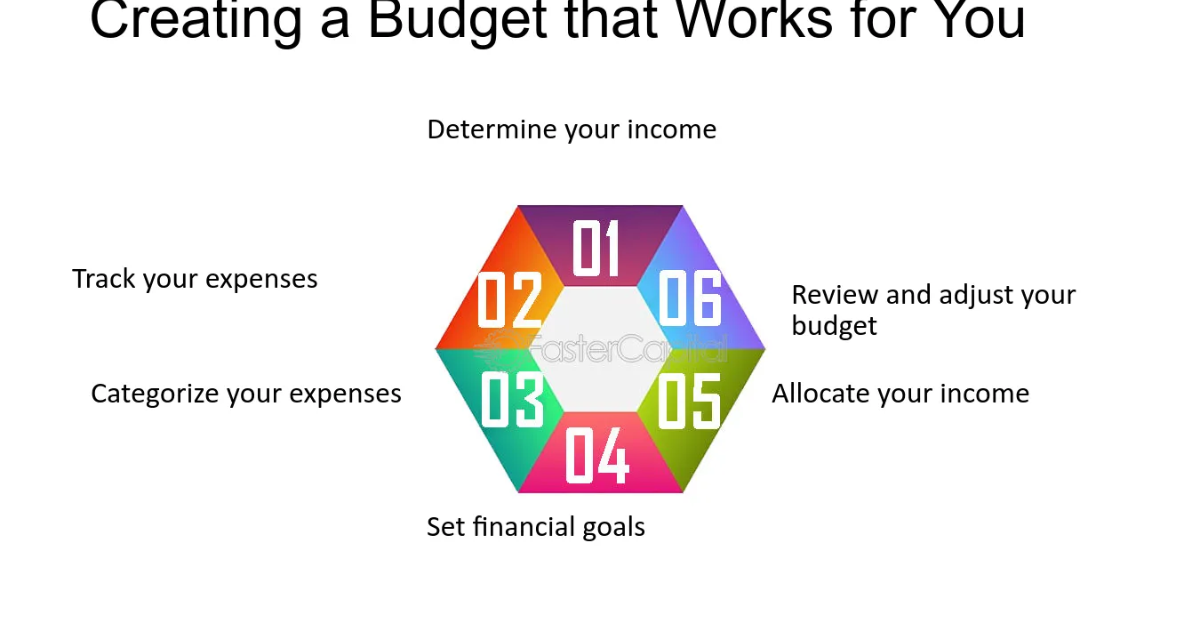

Steps to Create a Budget

Once you’ve identified the right time to start budgeting, follow these steps to create a budget that suits your lifestyle:

- Gather Financial Information: Collect all relevant financial information, including income statements, bills, and bank statements.

- Identify Income Sources: List all sources of income, including salary, bonuses, and any side gigs.

- Track Your Expenses: Record your monthly expenses, categorizing them into fixed expenses (rent, utilities) and variable expenses (groceries, entertainment).

- Set Financial Goals: Determine short-term and long-term financial goals, such as saving for a vacation or a house down payment.

- Create the Budget: Use a budgeting method that works for you—envelope system, zero-based budgeting, or a budgeting app. Allocate funds to each category and ensure you are prioritizing savings and debt repayment.

- Review and Adjust Regularly: Your budget isn’t set in stone. Review it monthly to track your progress, adjust as needed, and ensure you stay on track with your goals.